Understanding Break-Even Analysis for Digital Products: A Comprehensive Guide

As a business owner, one of your primary objectives is to make a profit. However, determining the right price to charge for your digital product can be a daunting task. This is where break-even analysis comes into play. In this blog post, we will discuss what break-even analysis is, how it works, and why it's essential for your digital product's success.

What Is Break-Even Analysis?

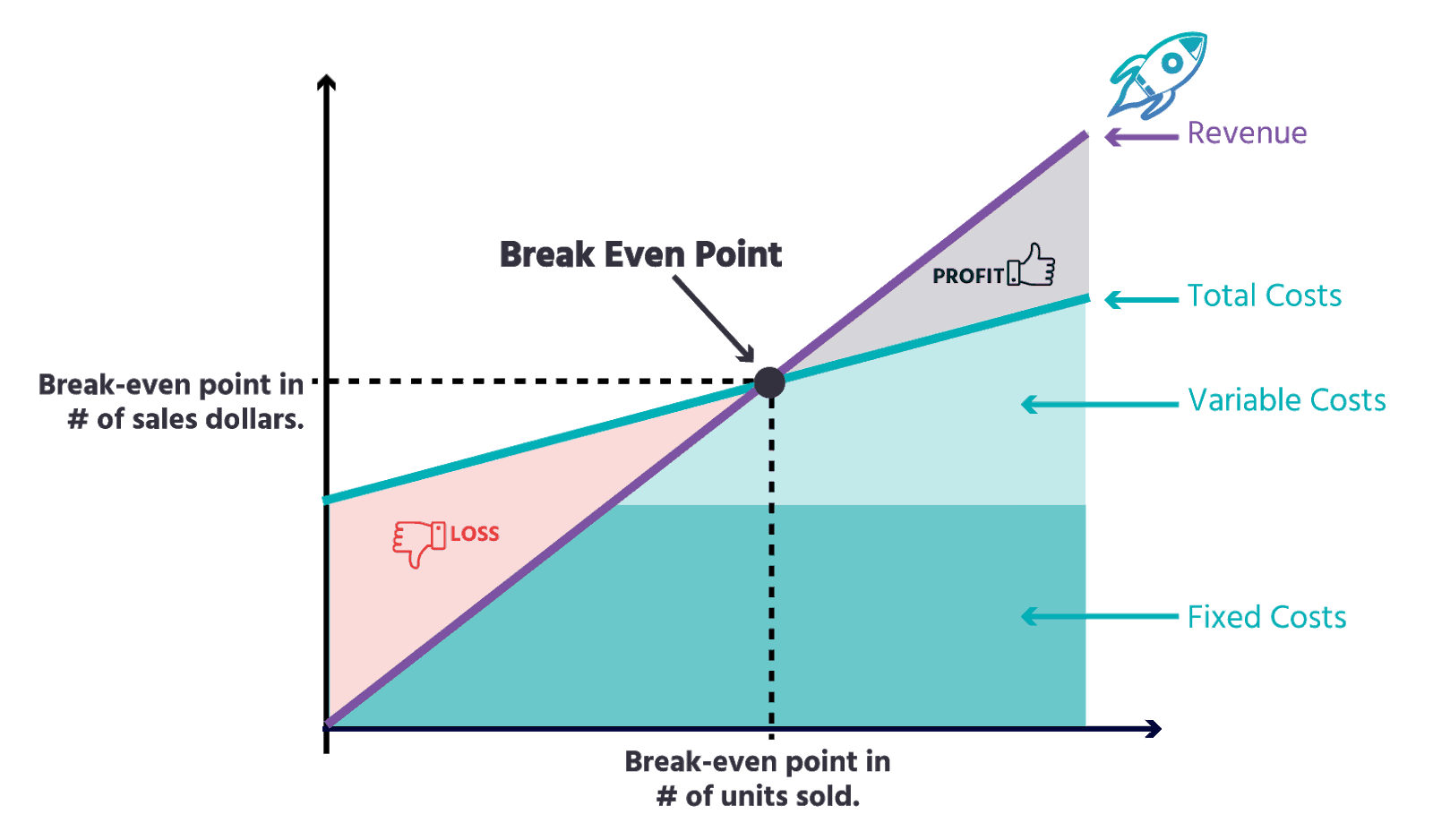

Break-even analysis is a financial analysis technique used to determine the point at which a digital product's total revenue equals its total costs, resulting in neither a profit nor a loss. It helps identify the level of sales needed to cover all the expenses associated with creating and selling the digital product. By performing a break-even analysis, you can determine the minimum level of sales required to cover your costs and make a profit.

How Does Break-Even Analysis Works?

To perform a break-even analysis for a digital product, you need to identify all the costs associated with creating and selling the product, including fixed costs (such as software development costs, hosting fees, and marketing expenses) and variable costs (such as payment processing fees and customer support costs). Once you have identified all the costs, you need to calculate the price at which you will sell the product and estimate the number of units you expect to sell.

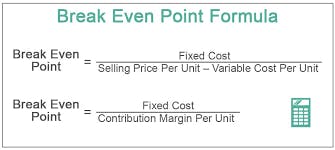

The break-even point is calculated by dividing the total fixed costs by the difference between the selling price per unit and the variable cost per unit. This formula helps you determine the number of units you need to sell to break even.

Why Does Your Business Need to Perform Break-Even Analysis?

Performing a break-even analysis is crucial for businesses of all sizes, as it helps them understand the minimum level of sales required to cover their costs and make a profit. Here are some key reasons why your business should perform a break-even analysis:

Pricing decisions: Break-even analysis can help you determine the minimum price you need to charge for your product or service to cover your costs. If your costs are high, you may need to charge a higher price to break even, which can impact your pricing strategy.

Cost management: By identifying your fixed and variable costs, break-even analysis can help you understand where you can cut costs to improve profitability. You can identify areas where you can reduce costs or increase efficiency to reduce your break-even point and improve profitability.

Investment decisions: Break-even analysis can help you make informed investment decisions by providing you with a clear understanding of the financial impact of your investments. You can use the analysis to determine whether a new investment will help you achieve profitability or increase your break-even point.

Financial planning: Break-even analysis can help you develop a financial plan for your business by providing you with a clear understanding of your costs, revenue, and profitability. This can help you set goals and make informed decisions about resource allocation.

Risk assessment: Break-even analysis can help you assess the risks associated with your business by providing you with an understanding of your financial situation. By knowing your break-even point, you can identify potential risks to your profitability and take steps to mitigate them.

How Do You Calculate the Break-Even Point?

To calculate the break-even point, you need to determine the fixed costs, variable costs, and contribution margin per unit. The contribution margin per unit is the difference between the selling price per unit and the variable costs per unit. Once you have this information, you can calculate the break-even point in units and dollars.

In conclusion, performing a break-even analysis is critical for any business that wants to be financially sustainable and profitable. It provides valuable insights into your costs, revenue, and profitability, which can help you make informed decisions about pricing, cost management, investment, financial planning, and risk assessment. By understanding your break-even point, you can set achievable sales

Thank you 🙌🏻 for taking the time to read this conversation. I hope that I was able to provide useful information and insights. If you have any further questions or concerns, please do not hesitate to ask in comments 👇🏻👇🏻